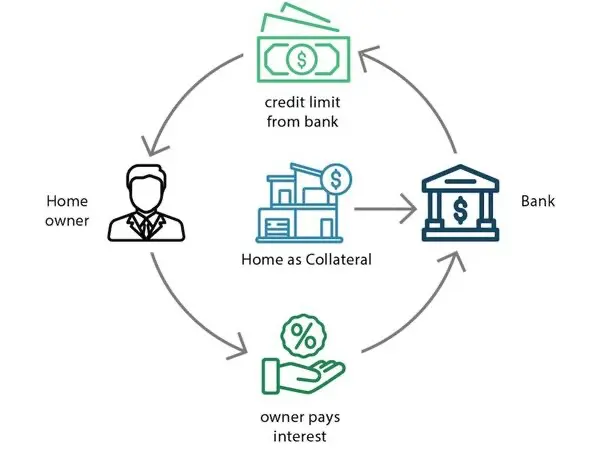

Personal loans are straightforward: you receive a lump sum upfront, which you repay over a fixed term through scheduled monthly payments. This structured approach can be advantageous if you have a specific expense in mind, such as buying a car or funding a wedding. With a personal loan, you know exactly how much you're borrowing, the interest rate, and the repayment period from the outset, providing clarity and predictability to your financial planning. One of the main benefits of personal loans is their fixed interest rates. This means your monthly payments remain consistent throughout the repayment period, making budgeting easier and offering protection against interest rate fluctuations. Additionally, personal loans typically have a set repayment term, which can range from one to seven years, allowing you to tailor the loan to your financial goals and timeline. However, it's important to note that personal loans may come with origination fees and prepayment penalties, so be sure to factor in these costs when evaluating your options. Additionally, if you require ongoing access to funds or anticipate needing additional financing in the future, a personal loan's one-time disbursement may not be the ideal solution. A line of credit, on the other hand, offers greater flexibility and convenience for borrowers who require intermittent access to funds or want a financial safety net for unexpected expenses. Unlike a personal loan, which provides a lump sum upfront, a line of credit establishes a maximum borrowing limit from which you can draw funds as needed. You only pay interest on the amount you borrow, not the entire credit limit, making it a cost-effective solution for managing fluctuating expenses. Lines of credit come in two primary forms: secured and unsecured. Secured lines of credit are backed by collateral, such as your home or investments, which can result in lower interest rates but pose a risk to your assets if you default on the loan. Unsecured lines of credit, on the other hand, do not require collateral but may come with higher interest rates and stricter eligibility criteria. One of the key advantages of lines of credit is their revolving nature. As you repay the borrowed amount, those funds become available for future use, providing a continuous source of financing. This flexibility makes lines of credit an attractive option for ongoing projects, emergency funds, or bridging temporary cash flow gaps. However, the variable interest rates associated with lines of credit can make budgeting more challenging, as your monthly payments may fluctuate based on market conditions. Additionally, lines of credit often have minimum monthly payments that may increase as your outstanding balance grows, so it's crucial to manage your borrowing responsibly to avoid accruing excessive debt. When deciding between a personal loan and a line of credit, consider your financial situation, borrowing needs, and long-term goals. If you have a specific expense in mind and prefer predictable monthly payments, a personal loan may be the best fit. On the other hand, if you require flexibility and ongoing access to funds, a line of credit could better suit your needs. Ultimately, the best option depends on your individual circumstances and preferences. Before making a decision, compare the terms, fees, and interest rates of different lenders, and carefully assess how each option aligns with your financial objectives. By understanding the differences between personal loans and lines of credit, you can make an informed choice that empowers you to achieve your financial goals with confidence.Personal Loans: A Lump Sum Solution

Lines of Credit: Flexible Access to Funds

Choosing the Right Option for You

Personal Loan vs. Line of Credit: Which is Right for You?

In the realm of personal finance, securing funding can be a pivotal decision. Whether you're aiming to consolidate debt, finance a home renovation, or cover unexpected expenses, understanding the nuances between different borrowing options is essential. Two common choices individuals often consider are personal loans and lines of credit. Both offer access to funds, but they function differently and cater to varying financial needs. So, which option is best suited for you? Let's delve into the details.